Premium finance software for insurance companies and brokerages

Automate your financing operations with the leading tool across U.S. and Canada

22+ years | 100+ clients | Developed by industry experts

Meet client needs

Service more, save time with less work

Keep operating

costs low

Scale as you

grow

See our software in action

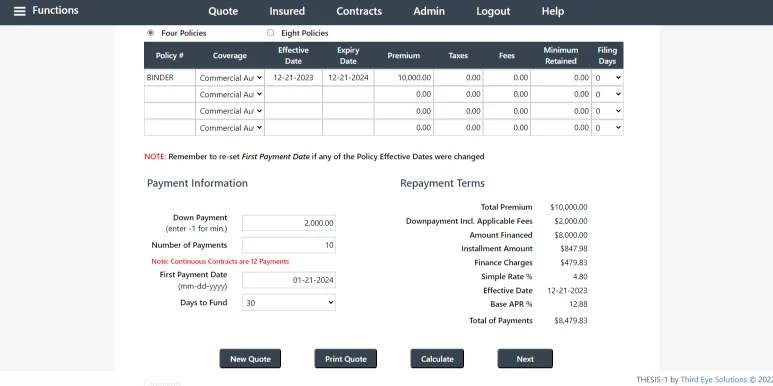

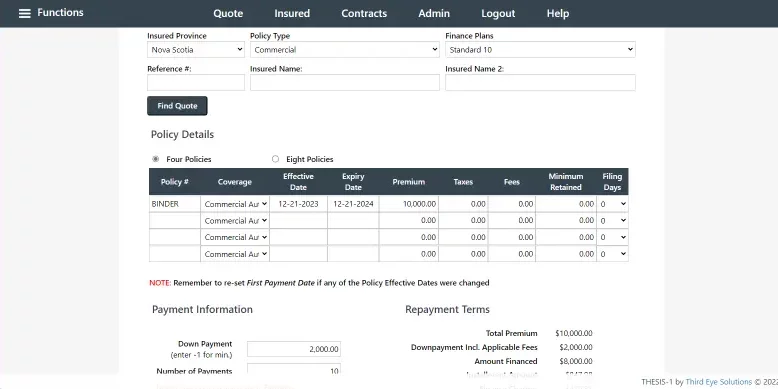

Create quotes with easy-to-use interface

Provide transparent repayment terms

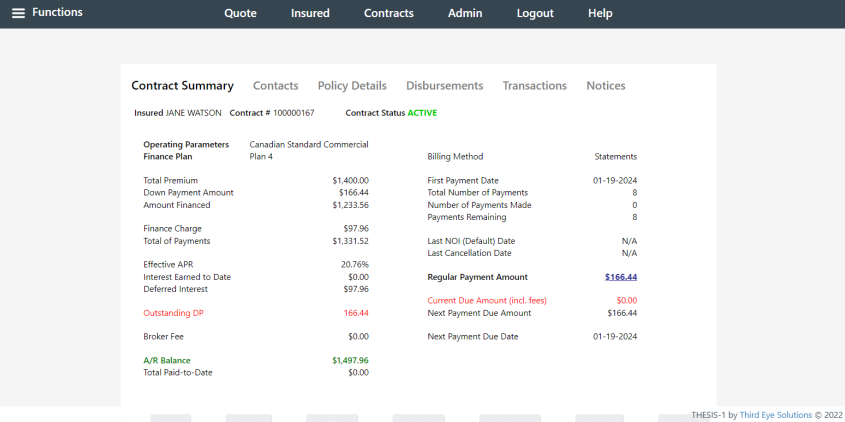

Monitor loan status and transactions

Hear from our clients

“Third Eye Solutions has been a valuable partner to our firm for over 10 years. Their quick response support, system flexibility and leadership’s commitment to getting it right simply put them at the top of the list in my book. I would recommend Third Eye and their products with the utmost confidence.”

Jay Pursell | President, COST Financial Group, Inc.

”IPC has used the Third Eye software for 3 years. Working with Third Eye from the beginning has been such a positive experience. They thoroughly understand the premium finance business and the needs we have as a finance company owned by a general agent. Their willingness to make custom changes in a timely fashion and to answer any questions that we have is exceptional. We pride ourselves on offering customer service to our customers and Third Eye makes it possible to do just that.”

Robin Smith | VP/General Manager, Insurance Payment Company, Inc.

“We were looking for a software solution to add the unique facets of premium financing to our suite of commercial lending products…particularly the need to provide a flexible, user-friendly experience to the agent in the field and the insured. The team at Third Eye delivered in every respect, particularly with the need to have our own documents delivered to the agent and to the insured. TE said they could do it…..and they did!”

Todd Marye | VP Loan Systems & Service Manager, Red River Bank

Why Third Eye Solutions

Our software does more than quoting and billing

Custom payment

Increase Customer Satisfaction and Borrower Goodwill with custom payments. Provide the flexibility to choose different payment frequencies, adjust the loan term, or accelerate the loan payoff.

Exception rules

Handle cases faster through custom rules tailored to your business needs, like Custom Client Refunds and Write-Off rules, thus improving efficiency, reducing errors, and ensuring compliance with regulatory requirements.

Delivery of notices and advisements

Generate and send important communications to borrowers without manual intervention. Notices and advisements can be triggered by specific events, conditions, or predefined timelines, reducing administrative overhead.

Tailored agency fee, producer fee, and broker fee programs

Leverage custom fee structures, fee tracking and management, and flexible fee adjustments for loan agencies, producers, and brokers to increase transaction accountability and transparency.

Collections & follow-up management

Improve the efficiency of the collection process through delinquency tracking, automated follow-ups, and an organised reporting structure.

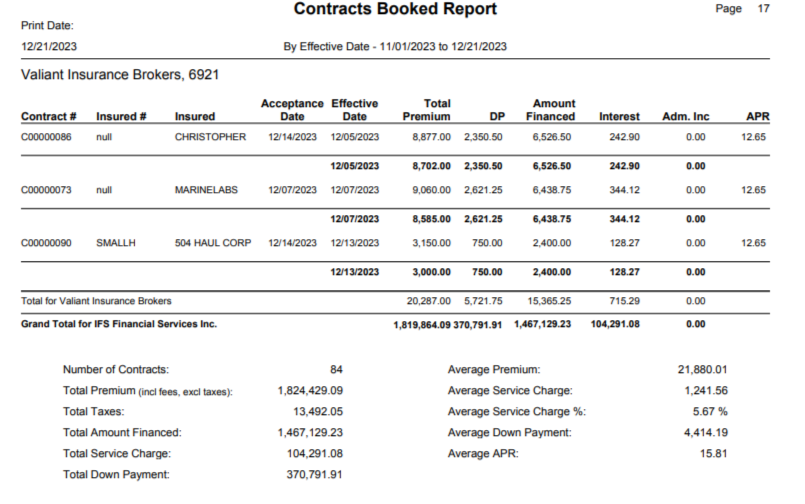

Accounting & reporting

Strengthen investor confidence through accurate GAAP reporting and enhanced compliance through consolidated financial reporting with audit tracking/trails.

Manage end-to-end premium financing in a couple of clicks

Including a mid-term payout requiring interest credit, applying a credit endorsement or processing an AP and recalculating repayment terms.

Integrate with Epic, Salesforce, or Any Agency or Policy Management System

Provide for Customer Self Servicing with our Insured Portal

Learn how to launch your premium finance program with our comprehensive guide.

Explore

See the power of our premium finance software in action. Book your personalized demo today and transform your financial management.